Fractional Ownership

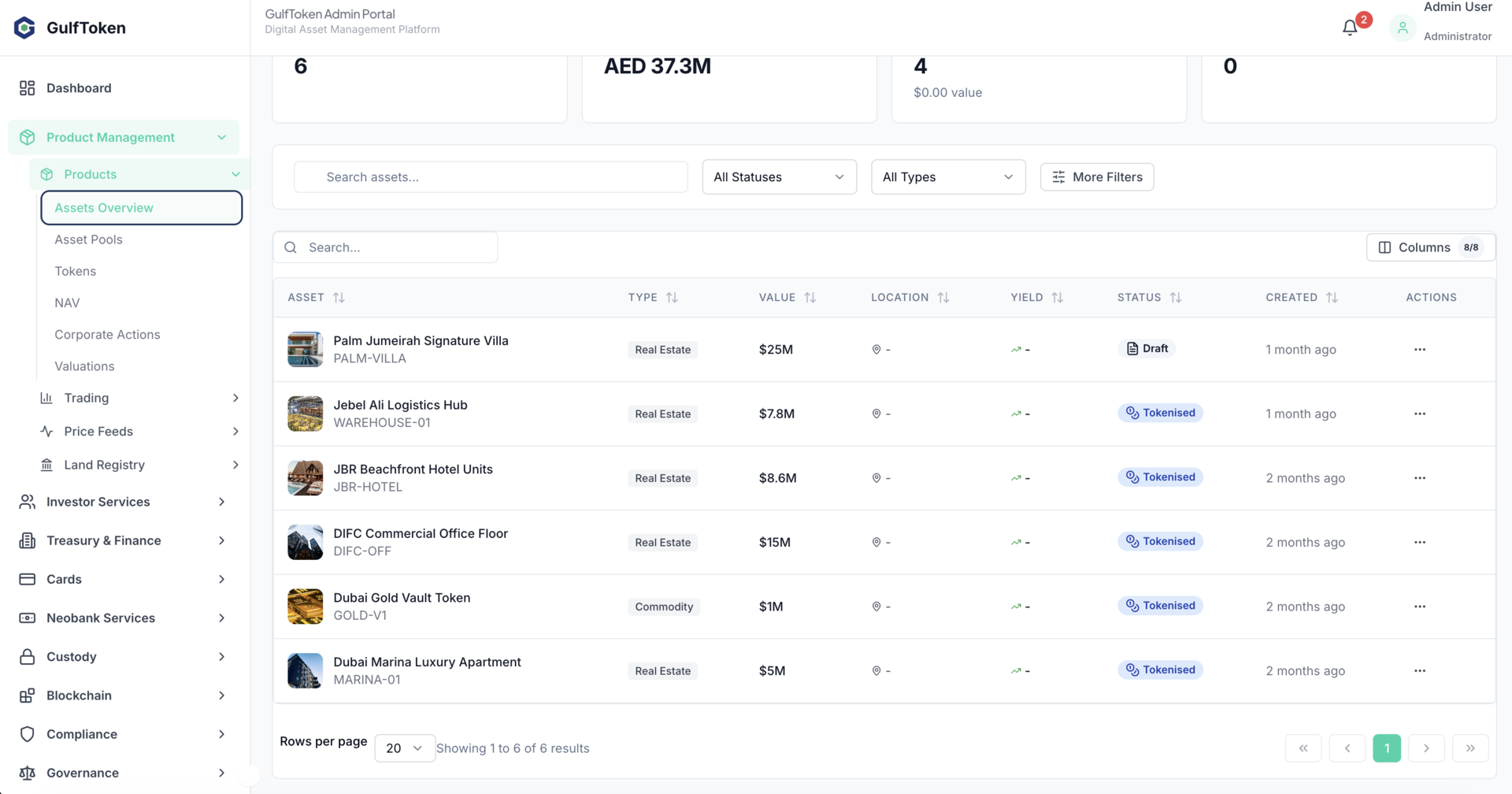

Tokenize real estate, commodities, and financial assets. Lower minimums open premium investments to more investors.

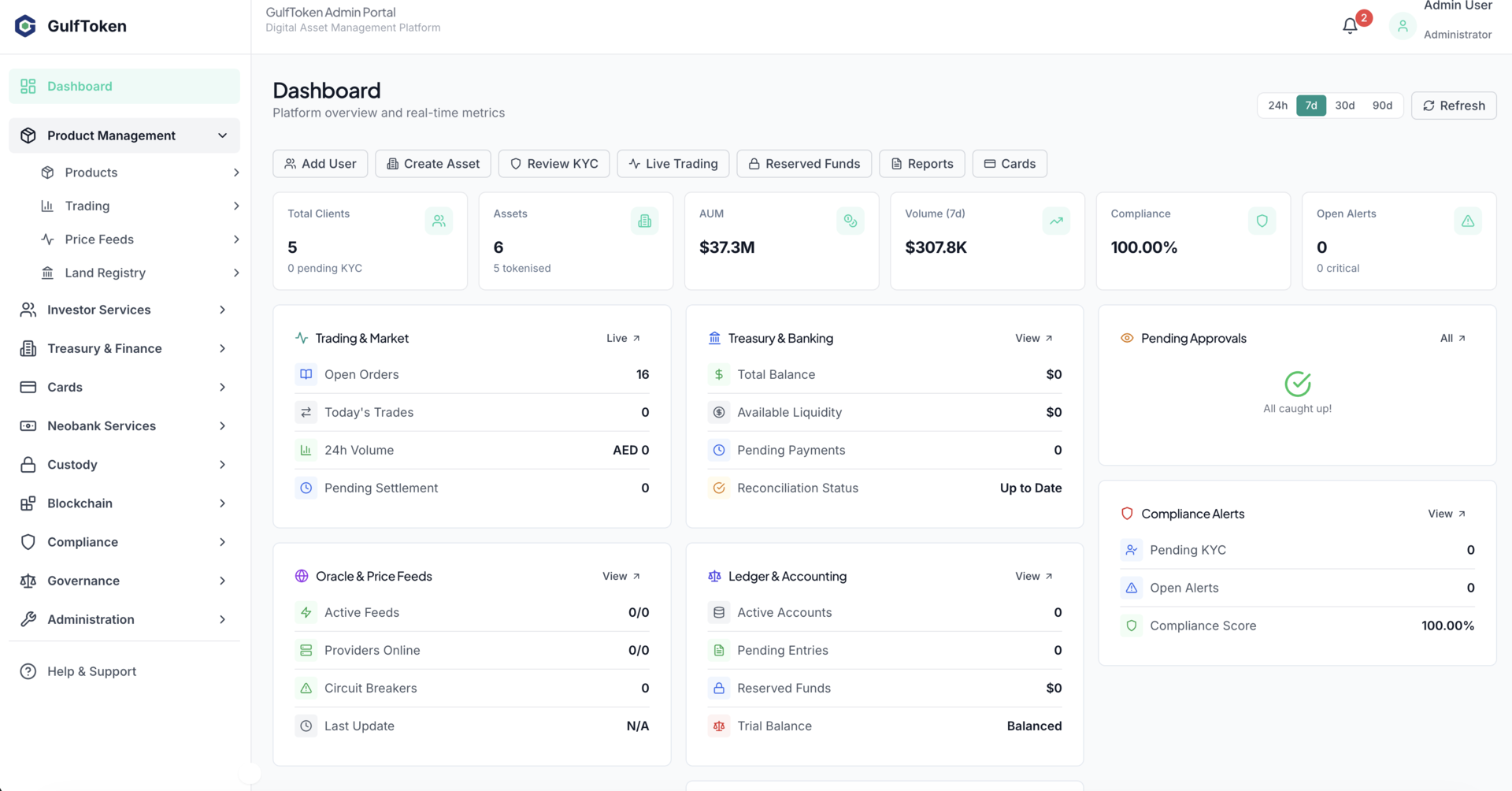

Deploy tokenization, neobanking, or both. Our modular, white-label platform adapts to your business model with end-to-end compliant and on-chain records.

Deploy asset tokenization, neobanking, or both—our modular architecture adapts to your business model

Tokenize real estate, commodities, and financial assets. Lower minimums open premium investments to more investors.

Secondary market trading with order book matching. Exit positions without waiting for redemption windows.

Chainlink-powered attestation proves on-chain that tokenized assets are fully backed by real-world holdings.

Automated dividend and income distribution to token holders. Transparent, auditable, and compliant.

Mastercard-powered prepaid cards with real-time JIT funding, spending controls, and instant virtual card issuance.

Hold, send, and receive multiple currencies. Competitive FX rates for international transfers and conversions.

Full account management with IBAN, domestic and international payments, FX services, and statements. Everything your customers expect from a modern bank.

Built-in customer acquisition tools. Reward customers for bringing friends with configurable bonus structures.

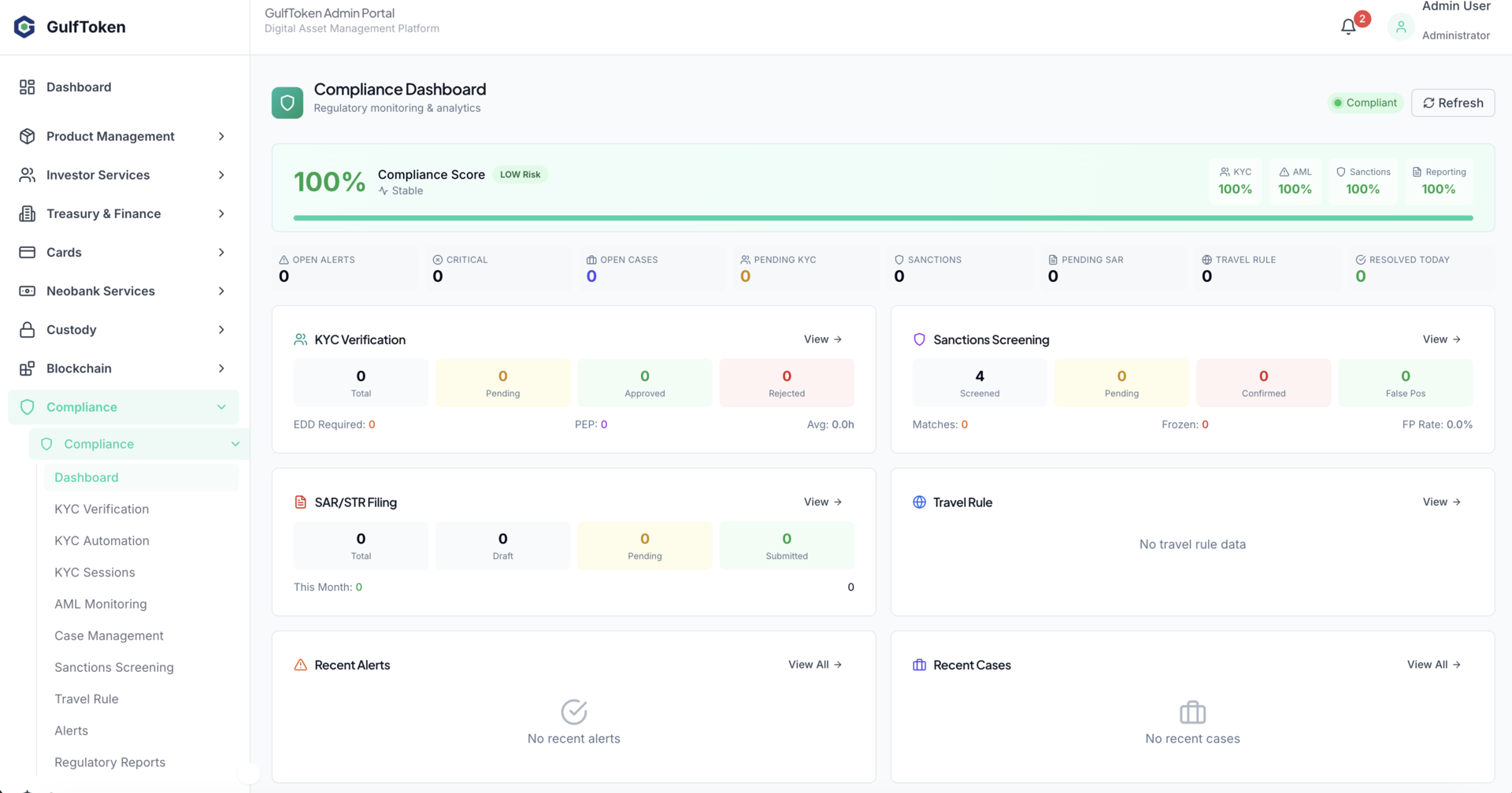

Multi-provider identity verification, sanctions screening, and travel rule compliance. Built for VARA, FINMA, MAS, and FCA.

Fireblocks integration for institutional-grade digital asset custody. MPC wallets with multi-signature controls.

Complete audit history for every action. Hash-chain verification ensures tamper-proof regulatory records.

Full accounting system with sub-ledgers for investors, assets, and treasury. Bank-grade financial controls.

Four proven use cases, one technology platform. Deploy individually or combine for a complete financial ecosystem.

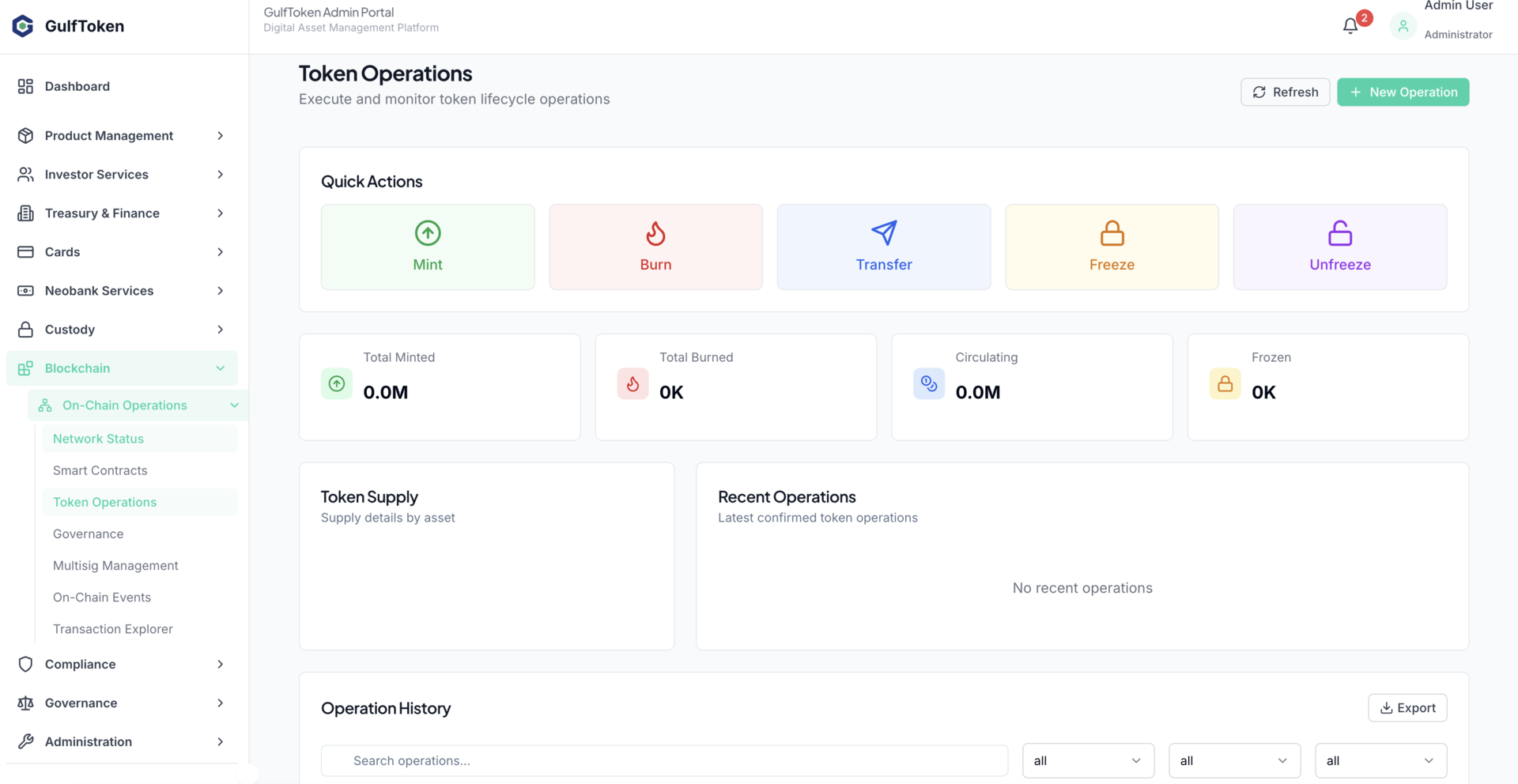

Real-world assets on the blockchain

Transform illiquid assets into tradeable digital tokens. Handle the complete lifecycle from onboarding through compliance, trading, and yield distribution.

Complete banking-as-a-service platform

Launch a full-featured digital bank with multi-currency accounts, payments, FX services, savings pots, and customer management. BaaS-ready architecture.

Prepaid card programme technology

Issue Mastercard prepaid cards with real-time JIT funding, granular spending controls, and complete lifecycle management. Virtual and physical card support.

Intelligent wealth management

Nine purpose-built AI services transform your platform. Automated document analysis, risk scoring, portfolio optimisation, compliance automation, and conversational support.

Explore some sample tokenized real-world assets available on the GulfToken platform staging environment

Loading assets...

Fractionalize large assets to reach more investors and create flexible redemption paths.

Lower minimums and auditable on-chain records broaden participation while increasing transparency.

KYC/AML orchestration, role-based permissions, and standardized disclosures built into the flow.

Launch a full-featured digital bank in months, not years. Pre-built modules for accounts, payments, cards, and savings.

Start with cards only, add payments later, integrate savings when ready. Each module works standalone or together.

Your brand, your experience. Full customisation of portals, mobile apps, and customer communications.

Real World Asset (RWA) tokenization is transforming how traditional assets are owned, traded, and managed. By converting physical assets like real estate, commodities, art, and infrastructure into digital tokens on a blockchain, tokenization creates unprecedented opportunities for both asset owners and investors.

The global tokenization market is experiencing rapid growth, with industry analysts projecting it to reach $16 trillion by 2030. Major financial institutions including BlackRock, JPMorgan, and Goldman Sachs have launched tokenization initiatives, signaling mainstream adoption. In 2024 alone, tokenized assets on public blockchains exceeded $3 billion, with real estate and private credit leading the charge.

What makes tokenization compelling is its ability to solve long-standing inefficiencies in traditional markets. Settlement times shrink from days to minutes. Fractional ownership opens premium assets to retail investors who previously lacked access. Smart contracts automate dividend distributions, compliance checks, and corporate actions. Meanwhile, the immutable audit trail provides regulators and investors with transparency that was never before possible.

The UAE has emerged as a global leader in this space, with VARA (Virtual Assets Regulatory Authority) establishing one of the world's most comprehensive frameworks for digital assets. This regulatory clarity, combined with the region's strategic position between East and West, makes it an ideal hub for tokenized asset issuance and trading. GulfToken's technology is purpose-built to meet these evolving regulatory standards while delivering the efficiency and accessibility that modern investors demand.

Digital-first banking has moved from disruptor to mainstream. Consumers now expect instant account opening, real-time payments, intelligent savings tools, and seamless card experiences—all accessible from their smartphone. Traditional banks are racing to modernise, while new entrants are launching purpose-built digital propositions.

The global neobanking market reached $98 billion in 2024 and is projected to grow at 13.5% annually through 2030. Success stories like Revolut, Monzo, and Nubank have demonstrated that modern banking technology combined with exceptional user experience can rapidly capture market share even in mature markets.

For financial institutions, the build-vs-buy decision has never been clearer. Building core banking systems from scratch requires years of development and hundreds of millions in investment. GulfToken's platform offers a third way: enterprise-grade technology that can be deployed in months, with the flexibility to customise every aspect of the customer experience.

Our banking modules include multi-currency wallets, domestic and international payments, FX services, prepaid card programmes with real-time JIT funding, savings pots with round-ups and goals, and comprehensive customer support ticketing. All backed by the same compliance infrastructure that powers our tokenization platform—KYC/AML, sanctions screening, and full audit trails.

Ready to tokenize your assets or learn more about our platform? We'd love to hear from you.

Tokenize real estate, commodities, carbon credits, and more.

Access fractional ownership with full regulatory compliance.

Join our ecosystem for compliance, custody, and distribution.